Europe Can Reshore Production Without Increasing Costs

By Rajan Suri – Founder of Quick Response Manufacturing

Over the last 20 years European manufacturers have seen large numbers of jobs being lost while production has been “outsourced” to Low-Cost Countries (LCCs). Even though much lip service has been given to bringing production back to Europe – or “Reshoring” as this concept is now popularly called – not much progress has been made. The reason is simple: management’s worry about “bottom line” results. Most managers assume that since labor costs in Europe are 5 to 10 times higher than in the LCCs, it will cost much more to manufacture in European factories or to purchase components made locally, and this will hurt their profits.

However, now that the crisis in global supply chains is creating huge delays in delivery there is renewed focus on reshoring of products. Despite this opportunity, managers still struggle with this difficult tradeoff: Should we reshore production for delivery reliability and take a hit on our bottom line, or should we continue to leave production in LCCs and risk disruptions but make better profits?

The good news is that there does not need to be a tradeoff – or, to rephrase a popular saying, “You CAN eat your cake AND have it too!”. Members of the QRM Institute have worked with dozens of companies throughout Europe to show that manufacturers can reshore production while simultaneously reducing costs!

These results have been achieved through the implementation of Quick Response Manufacturing (QRM). QRM is a strategy developed over two decades, starting at the QRM Center in USA and then spreading throughout Europe with the help of the QRM Institute’s Members.

To see how QRM enables companies to reshore production at competitive cost, you need to understand three insights from QRM principles:

- Realizing why the focus on labor costs is a misdirected management strategy

- Shifting from cost-based management to time-based management

- Taking advantage of 21st century markets

We now elaborate on these three insights.

Insight #1: Focus on Labor Costs is a Misdirected Management Concern

The first insight requires a deeper examination of true costs. Managers make production or sourcing decisions based on (estimated) product costs. However, we need to better understand the system-wide costs for a manufacturing enterprise. The common perception is that LCCs have a big advantage because their labor costs are a fraction of labor costs in Europe. However, we should be looking at the total annual operating costs for an enterprise, not individual product prices. For most European manufacturing companies, direct labor (people actually doing the machining, fabrication, assembly, and so on) accounts for less than 10% of their annual operating costs. Another 50% or so is for indirect costs in the two categories of overhead and SG&A (Selling, General and Administrative) costs. The remaining 40% of costs are for purchased items such as raw materials and components.

The lead time for products made in LCCs can be three months or more, including the factory lead time, transit time, and time at ports and customs (and in fact it is a lot more during this crisis!). Over the two decades of our work on QRM in both USA and Europe we have shown that these long lead times add a lot of indirect costs including forecasting, planning (and re-planning!), managing work-in-process, warehousing of finished goods, freight costs for rushed shipping, time from salespersons and administration staff to manage the delays, and many more such tasks. By making products in-house and reducing total lead times by 50% or more, companies have significantly reduced their indirect costs. Also, by working with local suppliers to reduce their lead times (and thereby their costs), companies have been able to reduce their purchased item costs as well. Added together, these reductions have often exceeded 20%, eliminating the labor cost advantage of LCC competitors. The key here is for managers to look at these total operating costs, rather than the “piece price costs” for products being outsourced.

Insight #2: Shifting from Cost-based to Time-based Management

The second insight is that to significantly reduce lead times, managers need to shift from what we call “cost-based thinking” to QRM’s strategy of “time-based thinking.” The reason is that historically, manufacturing companies were organized to minimize the unit cost of each operation, and minimize the cost of each purchased item, but not to minimize the time it takes for products to flow through their system – in fact, quite the opposite – most of these decisions resulted in long lead times! This “cost-based thinking” pervades management decision-making and it is difficult to change established norms and move towards “time-based decisions” which focus on reducing response time.

A simple example helps to drive home the difference between these two decision-making approaches.

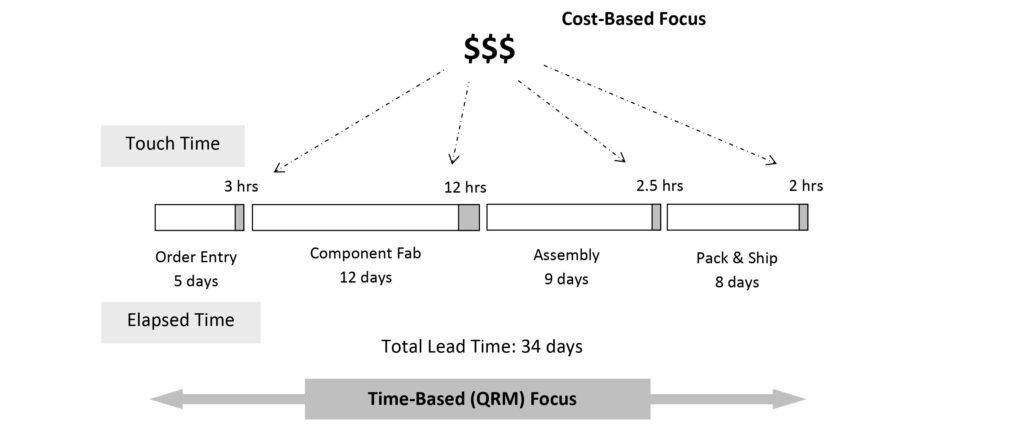

The chart here shows the progress of an actual order through a manufacturing company. The order spends 5 days in the Order Entry department, then it takes 12 days for components to be fabricated, 9 days for assembly to be completed, and 8 days until the order is packed and shipped—for a total lead time of 34 days within the company. The chart also shows the “touch time” – the gray space in the rectangles – when someone is actually working on the job. This accounts for under 20 hours, so based on an 8-hour day, the touch time is less than 2,5 days out of 34 days. The rest of the time is the “white space” in the rectangles, where nothing is happening to the job. This ratio is not unusual; from hundreds of projects at manufacturing companies in both USA and Europe we have observed that touch time typically accounts for less than 10% of lead time!

Traditional cost-based efficiency improvements focus on reducing the touch time (gray space). However, even a 20% reduction of the gray space would cut only half a day out of the lead time – barely a dent in the 34 days and not even perceptible to customers. To reduce lead time, companies need to shift from cost-based to time-based thinking, which requires management to focus on reduction of total lead time as their primary goal.

Reducing lead time, however, is not trivial: companies have to completely rethink their operations. At the QRM Center we developed a complete set of principles for how companies can reduce their enterprise-wide times, and the QRM Institute Members have helped to further refine and implement these principles in European companies. These QRM principles begin by detailing the organization structure needed to slash lead times, not only on the shop floor but also in the office. Next are new methods for capacity planning and material planning, and we complete the implementation with ways to change the mindset of the whole organization including use of novel performance metrics. As reported in dozens of case studies at conferences in both USA and Europe (see also the Cases on the QRM Institute website), with this QRM approach companies have reduced lead times by over 80% and product costs by 20-40%!

Insight #3: Exploiting 21st Century Markets

Our final insight is about taking advantage of the opportunities that companies have in today’s world. Unlike Henry Ford’s customers – his production line of 1913 turned out the same Black Model T in large quantities – customers today expect to select from thousands of options. In some markets customers even want products individually designed to their requirements. The 21st century customer also has the expectation of quick delivery – a few days or at most a couple of weeks. These expectations remain true whether your customer is an individual or another corporation.

Products made in LCCs have long lead times: first is the lead time at the factory in the LCC and then the products can spend two months or more in transit. If there are only a few product options, those can be shipped ahead from the LCC factory to a European distribution center. However, if you can supply thousands of options, the LCC competition would have to stock all of these in a large warehouse – a big financial drain for them. You gain even more competitive advantage if you can tailor each product to an individual customer’s requirements and still deliver it within a couple of weeks. The LCC factory would need transit time plus design and manufacturing time.

Companies making products for these “21st Century Markets” — namely high-mix, low-volume or customized products – have found that QRM strategy is ideally suited to their situation; the recent Lean Manufacturing methods are more suited to higher volume and lower variety. By exploiting these 21st Century Markets with QRM strategy, companies have seen huge increases in sales and market share.

Conclusion

At both the QRM Center in USA and the QRM Institute in Europe our partnerships with manufacturing companies have enabled local manufacturers to regain their competitive edge, reshore products, increase market share and profitability, and create significant numbers of manufacturing jobs in their communities.

About the Author

Rajan Suri is Emeritus Professor at the University of Wisconsin-Madison and Founding Director of the QRM Center. Dr. Suri also serves as Special Advisor to the QRM Institute Board. He is author of several books on QRM, including the popular book, It’s About Time. Dr. Suri has received several awards for his development and implementation of QRM, and in 2010 he was inducted into the Industry Week Manufacturing Hall of Fame.